Subscription period: October 16, 2025 – October 30, 2025 (please note that some nominee’s close subscriptions at an earlier date).

Trading with unit rights: October 16, 2025 – October 27, 2025.

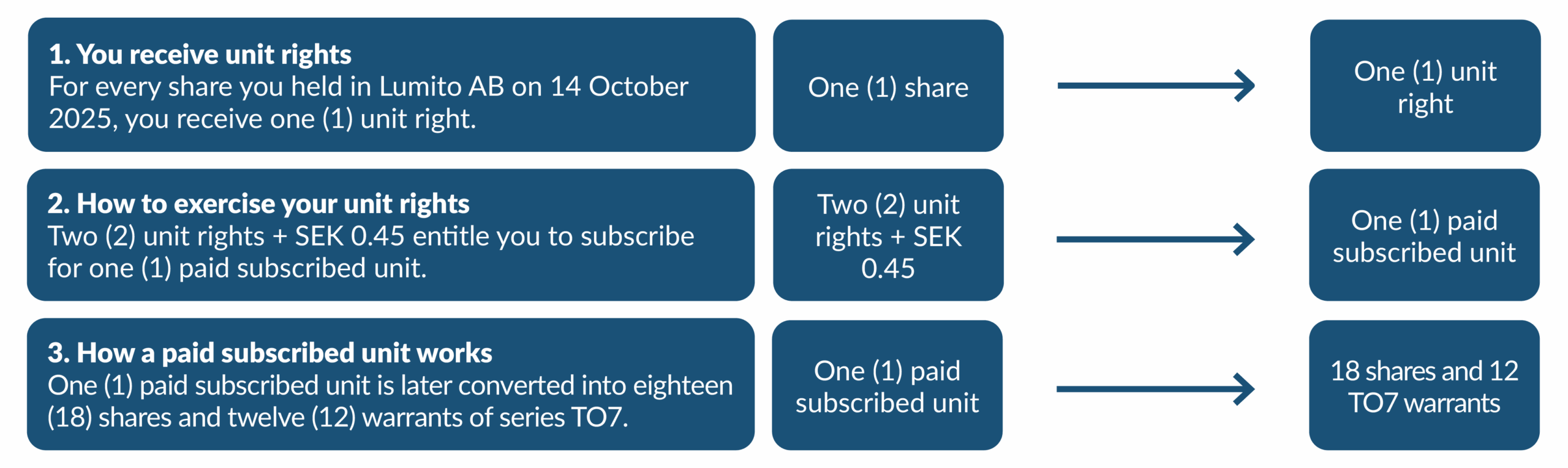

Subscription with preferential rights: One (1) existing share on the record date of October 14, 2025, entitles the holder to one (1) unit rights. Two (2) unit rights entitle the holder to subscribe for one (1) Unit, where each Unit consists of eighteen (18) shares and twelve (12) warrants of series TO7. In addition, investors are offered the opportunity to subscribe for Units without the support of unit rights.

Subscription price: The subscription price has been set at SEK 0.45 per Unit, which corresponds to a subscription price of SEK 0.025 per new share. The warrants will be issued free of charge.

Issue proceeds: Upon full subscription in the rights issue, the company may receive approximately SEK 60 million before issue costs.

Subscription commitments and Underwriting commitments: The rights issue is covered to approximately 60 percent, corresponding to about SEK 36 million, by subscription commitments and underwriting commitments. Of this, approximately 1 percent, corresponding to about SEK 0.6 million, refers to subscription commitments and approximately 59 percent, corresponding to about SEK 35.3 million, to underwriting commitments.

During the spring of 2025, Lumito has taken important steps forward in both development and commercialization. The company has established a Scientific Advisory Board consisting of internationally leading experts with extensive global networks, a strategic reinforcement that further supports continued commercial and technological development. The advisors have confirmed the potential of the company’s technology and product offering, and verified that Lumito addresses key needs in tissue analysis that are not met by currently available methods.

Since H2 2024, Lumito has achieved several important milestones that now pave the way for the commercial phase:

With a clear focus, a unique product, a dedicated team, and an effective scalable business model, Lumito is in an exciting phase. The company is well positioned to continue bringing its product to market and contributing to the development of the personalized and more effective medicines of the future.

Upon full subscription in the rights issue, the company will receive issue proceeds of approximately SEK 60 million before issue costs. Issue costs are estimated to amount to a maximum of approximately SEK 8.5 million. The company intends to use the net proceeds of SEK 51.4 million from the rights issue for the following purposes:

Lumito can also receive additional capital in June 2026 in connection with the exercise of warrants issued in connection with the rights issue, which is intended to be used for the following activities:

Important information

Due to legal restrictions, the information on this section of Lumito AB’s (the “Company”) website is not directed at or accessible to certain persons. We kindly ask you to review the following information and provide the following confirmation each time you wish to access this section of the website. Please note that the terms set out below may be altered or updated and therefore it is important that you review them each time you visit this section of the website.

The information contained in this section of the Company’s website is not intended for, and must not be accessed by, or distributed or disseminated, directly or indirectly, in whole or in part, to persons resident or physically present in the Australia, Belarus, Hong Kong, Japan, Canada, New Zealand, Russia, Switzerland, Singapore, South Africa, United Kingdom, United States or any jurisdiction where to do so might constitute a violation of the local securities laws or regulations of such jurisdiction, and does not constitute an offer to sell or the solicitation of an offer to buy or acquire, any subscription rights, paid subscribed shares (Sw. Betalda tecknade aktier) or any shares or other securities of the Company (“Securities”) in the Australia, Belarus, Hong Kong, Japan, Canada, New Zealand, Russia, Switzerland, Singapore, South Africa, United Kingdom, United States or any jurisdiction where to do so might constitute a violation of the local securities laws or regulations of such jurisdiction.

No Securities have been, or will be, registered under the U.S. Securities Act of 1933, as amended (the “Securities Act”) or the securities legislation of any state or other jurisdiction of the United States, and thus, Securities may not be offered, subscribed for, exercised, pledged, sold, resold, granted, delivered or otherwise transferred, directly or indirectly, within or to the United States except pursuant to an applicable exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and in compliance with any applicable securities laws of any state or other jurisdiction of the United States. No public offering of the Securities is being made in the United States. The Securities have not been and will not be registered under the applicable securities laws of Australia, Belarus, Hong Kong, Japan, Canada, New Zealand, Russia, Switzerland, Singapore, South Africa, United Kingdom or any other jurisdiction in which it would be unlawful or would require registration or other measures, and therefore may not be offered or sold directly or indirectly, within or to Australia, Belarus, Hong Kong, Japan, Canada, New Zealand, Russia, Switzerland, Singapore, South Africa, United Kingdom or any other jurisdiction in which it would be unlawful or would require registration or other measures.

No public offer of Securities is made in any country within the European Economic Area (“EEA”) other than Sweden. In other member states of the European Union (“EU”) or the United Kingdom, such an offer may only be made in accordance with the exemption in the regulation (EU) 2017/1129 (the “Prospectus Regulation”) or Regulation (EU) 2017/1129 as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018 (the “UK Prospectus Regulation”). In other countries in the EEA that have implemented the Prospectus Regulation in their national legislation, such an offer may only be made in accordance with the exemption in the Prospectus Regulation and/or in accordance with each relevant implementing measure. This portion of the website is directed only at persons in countries within the EEA or in the United Kingdom who are “qualified investors” within the meaning of Article 2(e) of the Prospectus Regulation or the UK Prospectus Regulation. In other countries in the EEA that have not implemented the Prospectus Regulation in their national legislation, such an offer may only be made in accordance with the applicable exemption in national legislation.

With respect to the United Kingdom, information and documentation contained on this portion of the website is directed only at (i) persons who are outside the United Kingdom or (ii) persons who have professional experience in matters relating to investments falling within Article 19(2) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended from time to time (the “Order”) or (iii) persons falling within Article 49(2)(a) to (d) (“high net worth companies, unincorporated associations etc.”) of the Order or (iv) certified high net worth individuals and certified and self-certified sophisticated investors as described in Articles 48, 50, and 50A respectively of the Order or (v) persons to whom the information may otherwise be lawfully communicated (all such persons together being referred to as “relevant persons”). The information mentioned in any document on the website will only be available to and directed and distributed to relevant persons. Any person whom is not a relevant person should not act or rely on the documents or any of its contents.

Access to the information and documents contained on this section of the Company’s website may be illegal in certain jurisdictions, and only certain categories of persons may be authorized to access such information and documents. All persons residing outside of Sweden who wish to have access to the documents contained on this website should first ensure that they are not subject to local laws or regulations that prohibit or restrict their right to access this section of the Company’s website, or require registration or approval for any acquisition of securities by them. No such registration or approval has been obtained outside Sweden. The Company assumes no responsibility if there is a violation of applicable law and regulations by any person.

If you are not permitted to view materials on this webpage or are in any doubt as to whether you are permitted to view these materials, please exit this webpage.

I certify that:

I am resident outside and physically present outside of the Australia, Belarus, Hong Kong, Japan, Canada, New Zealand, Russia, Switzerland, Singapore, South Africa, United Kingdom, United States or any jurisdiction where to do so might constitute a violation of the local securities laws or regulations of such jurisdiction; and

I am resident and physically present (a) in Sweden or (b) outside of Sweden and each of the jurisdictions referred to in item (1) above and, in that case, I am authorised to access the information and documents on this website without being subject to any legal restriction and without any action required by the Company; and

I will not distribute or otherwise send any information contained on this section on the Company’s webpage to any person resident in, or physically present in, any of the jurisdictions referred to in item (1) above; and

I have read, understand and agree to comply with the restrictions set forth above.